Uncategorized

New UPI Rules Are Here (August 1st): Why Your Bank’s Best Response is a Chatbot

- By admin_convo

- No Comments

01 Aug

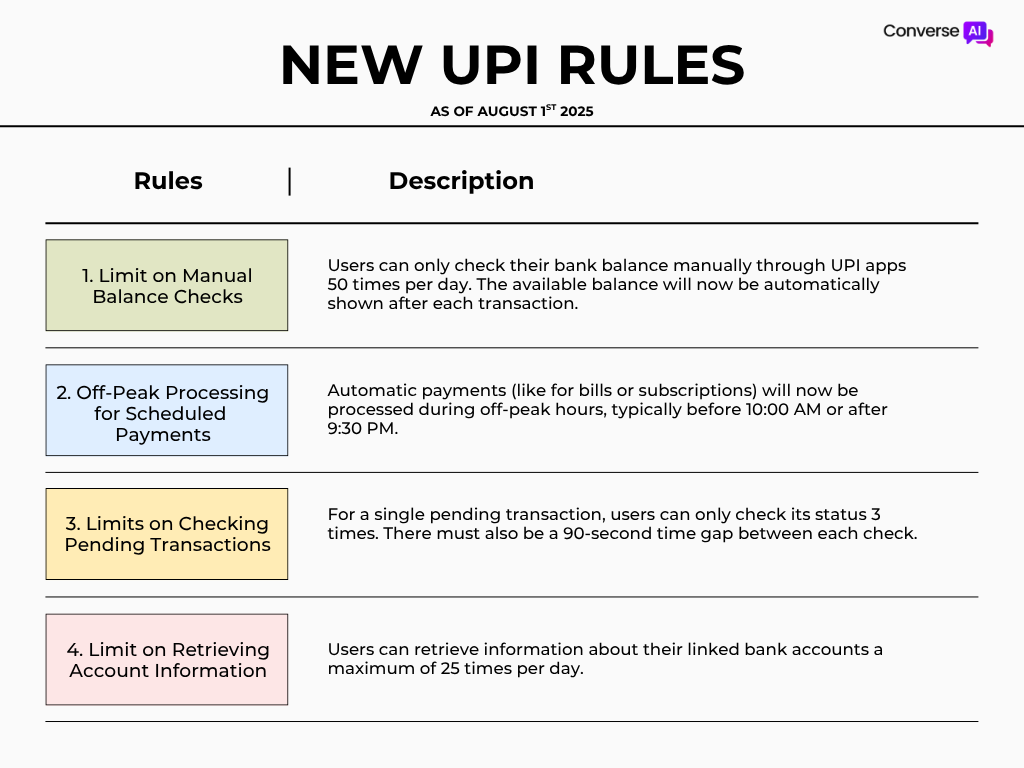

As of today, August 1, 2025, the landscape of digital payments in India has changed. The National Payments Corporation of India (NPCI) has rolled out new UPI rules, a move designed to strengthen the infrastructure of the nation’s most popular payment system.

But while these rules create stability for the system, they create a new reality for millions of users. New limits on balance checks, pending transaction inquiries, and payment schedules mean that customers have slightly less on-demand control than they are used to. This can create moments of confusion, friction, and anxiety.

For forward-thinking financial institutions, this isn’t a problem; it’s a golden opportunity. This is the moment to step in, bridge the “information gap,” and build unbreakable customer trust. The most effective tool to achieve this? A smart banking chatbot.

New UPI Rules

The intent behind the new rules is to reduce the load on the banking system’s APIs, preventing slowdowns during peak hours. However, the result for a customer is that they can no longer endlessly check a transaction status or their balance for that instant reassurance.

To understand the challenge, let’s look at the specific changes:

The Conversational Bridge: How a Banking Chatbot Solves Each New Challenge

Instead of forcing customers to call your support center in confusion, you can use automated chat to provide proactive clarity.

1. The Challenge: Balance Check Anxiety A customer makes a purchase and misses the balance that flashes on the screen. They want to check again but are worried about using up their daily limit.

The Chatbot Solution: Proactive Reassurance Your chatbot, integrated with WhatsApp or your web chat, can instantly send a confirmation message that provides more value than the UPI app itself.

“Hi Priya, your payment of ₹2,500 to [Store Name] was successful! Your updated account balance is ₹45,120. Your order #XYZ-789 is confirmed. Thank you!”

This provides a permanent, searchable record, eliminating the customer’s need to check manually.

2. The Challenge: Autopay Confusion A customer’s bill is due, but it’s 7 PM and the funds haven’t been debited. They worry the payment failed and they might incur a late fee.

The Chatbot Solution: Expert Guidance Your chatbot can be programmed with knowledge of the new off-peak rules. When the customer asks about their bill, it can respond with expert clarity.

“Hi Aman, I see your autopay for your electricity bill is active. As per the new UPI rules, scheduled payments are now processed after 9:30 PM to ensure system stability. You can rest assured it will be processed tonight, and we’ll send an instant confirmation once it’s done!”

You have just prevented a support ticket and positioned your brand as a knowledgeable guide.

3. The Challenge: Pending Transaction Stress This is the most stressful scenario. A customer’s payment is stuck, and the UPI app is now blocking them from checking its status.

The Chatbot Solution: A Support Lifeline Your banking chatbot becomes the single source of truth and comfort. The customer can start a chat and provide the transaction ID. The chatbot can then:

Acknowledge the stress: “I understand it’s worrying when a payment is pending.”

Provide a clear next step: “I see the transaction is still being processed by the bank. Please be assured that if it fails, the amount will be automatically refunded. Would you like me to send you a WhatsApp notification the moment the status changes?”

This masterfully turns anxious, repetitive checking into a managed, reassuring process where the customer feels taken care of.

Beyond the Rules: Why a Banking Chatbot is Essential Now

The new UPI rules are simply a catalyst. The underlying trend is that customers demand digital, convenient, and trustworthy financial interactions. A robust conversational AI platform like Converse AI is the key to delivering this experience, providing massive ROI through:

Reduced Call Center Load: Automating routine queries slashes operational costs.

Increased Lead Conversion: Pre-qualifying loan and credit applicants 24/7.

Enhanced Security: Operating within a compliant, end-to-end encrypted environment built for the BFSI industry.

The era of passive banking is over. The institutions that will win are those that communicate proactively, solve problems before they arise, and guide customers with clarity.

Here are some public examples and data points about chatbot success in Indian banking that you can refer to:

Federal Bank: Partnered with Google Cloud and Riafy to create “Feddy,” an AI-powered virtual agent. Their goal was to move beyond a simple FAQ chatbot to a truly interactive agent that could handle complex transactions. This highlights the trend of deep, meaningful AI integration.

HDFC Bank: Their chatbot, “Eva,” is cited as India’s largest banking chatbot, having handled millions of interactions with high accuracy. This demonstrates the scale at which conversational AI can operate.

General Industry Stats: Reports show that nearly 80% of Indian banks now utilize chatbots for everything from customer service to transactional work, with significant cost savings (some reports suggest over $8 billion annually by 2022) and improvements in customer satisfaction.

Ready to turn new regulations into a competitive advantage? Explore what a banking chatbot can do for your institution.

Recent Posts

Recent Comments

Company

Follow Us

Email: contact@theconverseai.com

Phone: +91-9982323333

+91-7023084065

A Product by Revti Digital